Need to Know: Why one bank says the best election outcome for stocks is more of the same

House Speaker Nancy Pelosi (C) and President Donald Trump (R) don't often see eye to eye.

Mark Wilson/Getty ImagesPresident Donald Trump and House Speaker Nancy Pelosi aren’t exactly the best of friends. But to strategists at French bank Société Générale, they are the best combination of leaders if the goal is the highest possible stock market.

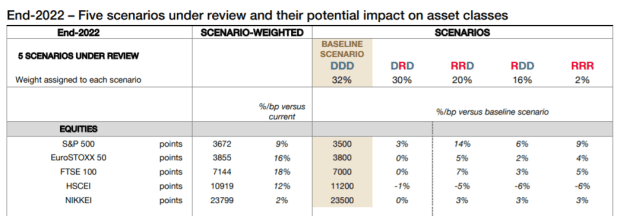

SocGen, in a detailed cross-asset report, examined five different U.S. election outcomes and what they mean for markets. The most likely outcome, they say, is a clean Democratic sweep, to which they assign a 32% chance; the second most likely outcome is a Joe Biden presidency with a Republican Senate, to which the analysts assign a 30% chance. They give a 20% chance to a Trump presidency with a Republican Senate and the Democrats in control of the House, a 16% chance to a Trump win with Democratic control of the House and Senate, and a 2% chance of a clean Republican sweep.

Over the next two years, monetary policy will remain loose no matter who wins, as will continued monetization of the public debt and strains in U.S.-Chinese relations, the bank says. Both presidencies will be focused on getting the economy back on track after COVID-19.

SocGen's scenarios for elections and stocks.

Taxes would be a clear area of differentiation, with Biden pledging to hike corporate taxes, as well as considering increases on income taxes for those making more than $400,000. The SocGen analysts don’t expect Biden to reverse Trump’s tariffs, but at the same time they expect him to refrain from introducing new levies. A Biden administration would seek to bolster the Patient Protection and Affordable Care Act (commonly known as Obamacare), while the analysts say Trump would likely be continually stymied in his efforts to reverse it.

A Biden presidency would coordinate more with other developed countries for “smooth and broad implementation of a digital tax, potentially putting a strain on the global tech sector and a drag on U.S. equities.” That could mean a further diversification out of the U.S. dollar DXY,

A Trump presidency would see a continuation of his American First agenda, though without a full sweep it would be difficult for him to push further tax cuts. Tensions between the U.S. and China would likely continue, but with less focus on tariffs, and more emphasis on Hong Kong, equity flows, and technology, the analysts say. A Democratic House would help counter the tightening fiscal impulses of Senate Republicans. In a Trump presidency, SocGen would prefer value stocks and midcaps with good balance sheets, as well as Japanese stocks NIK,

By the end of 2022, the S&P 500 SPX,

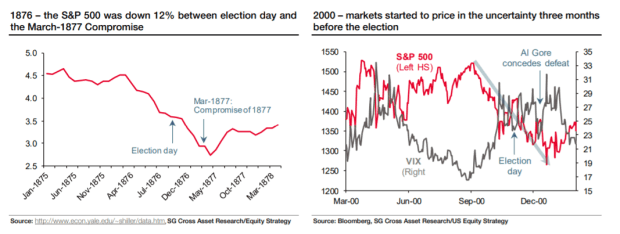

How markets responded to previous contested elections. The S&P 500 data from 1877 is imputed.

A contested election could lead to a stock-market correction on the order of 10% to 15%, and holding U.S. Treasury inflation-protected securities, gold and interest-rate volatility products could offer effective portfolio protection. But afterward, there would be a buying opportunity for stocks, as investors start to price in the early stage of the next economic cycle, and because of the ‘there-is-no-alternative’ trade.

The buzz

Tesla TSLA,

“With the Battery Day in the rearview, we think there is a lack of upcoming catalysts and are cautious about demand given the recessionary environment,” added Ben Kallo, an analyst at Baird, who put the electric-vehicle maker on its “fresh pick” list for a short-term drop in price.

Nike NKE,

Shopify SHOP,

Federal Reserve Chair Jerome Powell will go before the House Select Subcommittee on the Coronavirus Crisis, the second of three Capitol Hill appearances this week. Vice Chair for Supervision Randal Quarles will discuss the economic outlook, and a slate of regional Fed presidents also will speak. Flash purchasing managers indexes from the U.S. are due, after eurozone data missed estimates.

The markets

After a solid 140-point advance for the Dow industrials on Tuesday, U.S. stock futures ES00,

Gold futures GCZ20,

Random reads

The chief executive of Wells Fargo WFC,

A battery startup KCAC,

For the first time since 1944, a full moon will be visible in all time zones on Halloween.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

tinyurlis.gdu.nuclck.ruulvis.netshrtco.de