A woman rides a bicycle past a red light in Paris on September 23, 2020.

christophe archambault/Agence France-Presse/Getty Images European stocks dropped and U.S. stock futures weakened Thursday, as investors have largely given up on the idea that the U.S. Congress will provide new stimulus while worrying about a recent rise in COVID-19 cases.

After a 0.6% advance on Wednesday, the Stoxx Europe 600 SXXP,

The German DAX DAX,

U.S. stocks had a rough Wednesday, with the Dow Jones Industrial Average DJIA,

Economists at Goldman Sachs cut their U.S. growth forecast for the fourth quarter in half, to 3% from 6%. “We think it is now clear that Congress will not attach additional fiscal stimulus to the continuing resolution. This implies that after a final round of extra unemployment benefits that is currently being disbursed, any further fiscal support will likely have to wait until 2021,” the economists said. The continuing resolution is a reference to the extension of funding beyond the September-ending fiscal year, which the U.S. House has already passed.

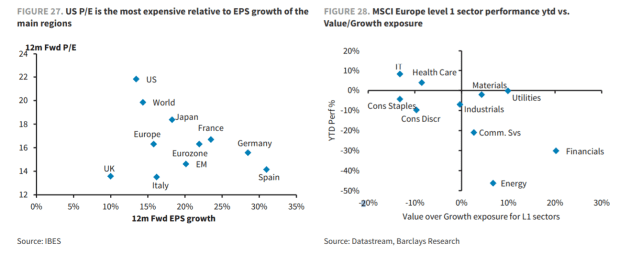

Ajay Rajadhyaksha, a New York-based strategist for U.K. bank Barclays, told clients that “the valuation gap between growth and value equities is now at such an extreme that value stocks offer positive asymmetry on the next leg of the recovery, which should help European and other non-U.S. indices.”

Of stocks on the move, Suez SEV,

Smiths Group SMIN,

Pets At Home PETS,

tinyurlis.gdclck.ruulvis.netshrtco.de

مقالات مشابه

- دریافت خوب مشکل, لازم, مشکل': Rep. John R. Lewis در کلمات خود

- چه کسی اسباب بازی را می خواهد؟

- داده ها نشان دهنده یک جهش و سپس کاهش در فعالیت جمعیت قبل از کریسمس گذشته است

- شرکت صادرات و واردات کالاهای مختلف از جمله کاشی و سرامیک و ارائه دهنده خدمات ترانزیت و بارگیری دریایی و ریلی و ترخیص کالا برای کشورهای مختلف از جمله روسیه و کشورهای حوزه cis و سایر نقاط جهان - بازرگانی علی قانعی

- NewsWatch: ورزشها میدارد سهام بد صنعت شرط گسترده منصه — آن را به پایان وارن بافت عصر

- کفش چرم زنانه - خرید جدیدترین کفش های چرمی زنانه

- پلنگ کاهش لئونارد Fournette را سال پنجم گزینه

- اعتباری است.com: حقیقت در مورد صورتحساب های پزشکی فرستاده شده به مجموعه

- استخر بادی - خرید آنلاین و بهترین قیمت استخر بادی

- کربن فعال شده گرانول |فروش